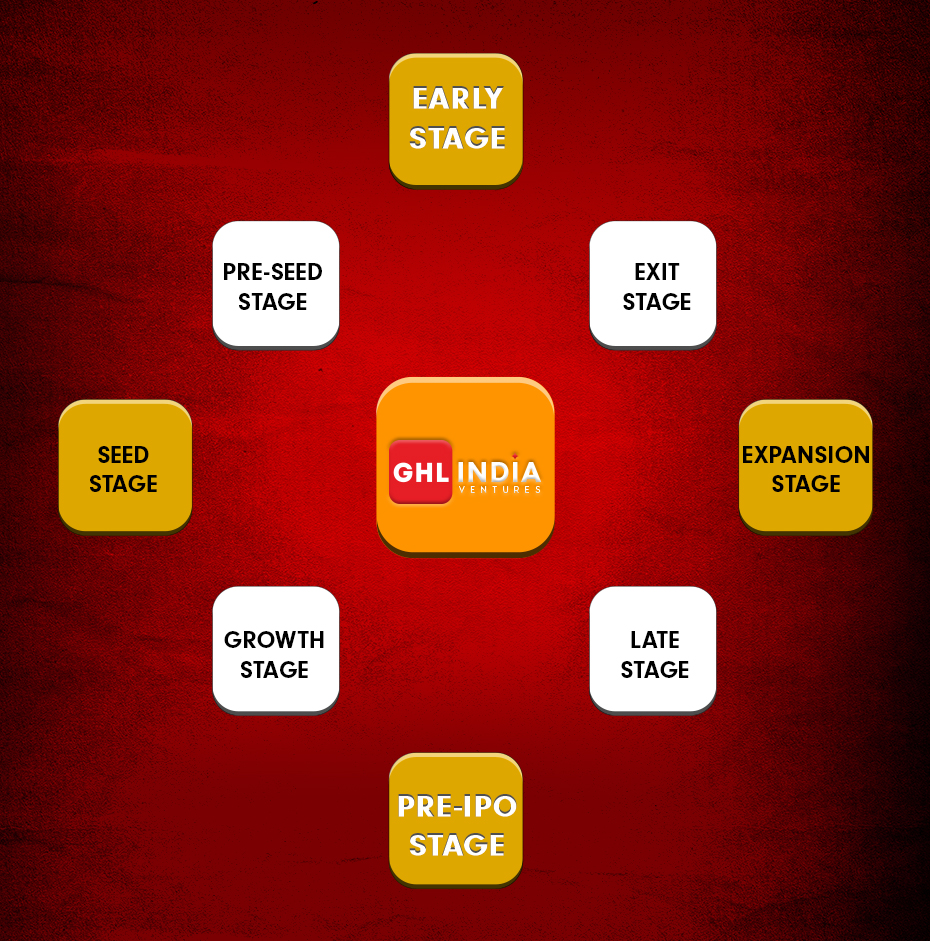

Looking for the right fit? we invest in growth.

Early-stage companies being young and not fully matured, hold the promise of substantial growth and future returns, has lower valuations, allowing investors to acquire larger equity stakes with smaller investments. Investing early provides significant influence and opportunities for early exits through acquisitions or IPOs. Additionally, it grants access to cutting-edge technologies, disruptive business models, and emerging trends.

Stressed Real Estate special situation

A burgeoning real estate firm specializing in the acquisition, development, and resale of distressed or stressed assets. With a proven track record in the industry, the company's core mission is to rejuvenate properties requiring renovation or repositioning, transforming them into profitable assets for both investors and end-users.

Fund manager speaks & ESG impact

Fund manager speaks

Naman Dhamija, as the Fund Manager of GHL India Venture, I am delighted to present our Alternative Investment Fund (AIF) to you. GHL India Venture Fund is poised to invest in high-potential early-stage and Pre-IPO companies, utilizing a meticulous selection process to identify disruptive solutions. With my extensive experience managing over $880 million in assets, I bring a keen eye for profitable opportunities and effective risk management.

Value creation for our fund is achieved through rigorous due diligence, active mentorship, and strategic partnerships with portfolio companies. GHL India provides not just capital, but also expertise, guidance and our involvement in key decisions helping portfolio entities to scale up effectively

Together, let us build a portfolio that not only delivers financial returns but also contributes to technological advancements and societal well-being. Thank you for your trust and partnership.

ESG impact

The world of alternative investments is increasingly recognizing the importance of Environmental, Social, and Governance (ESG) factors.

The world of alternative investments is increasingly recognizing the importance of Environmental, Social, and Governance (ESG) factors.

Unlock tailored solutions without the wasted effort. Talk to us today